Demystifying Car Depreciation: How to Maximize Your Vehicle's Value

Why is it that the moment you drive a new car off the dealership lot, you can almost hear the sound of thousands of dollars evaporating into thin air? And more importantly, is there anything you can actually do about it?

For two decades, I’ve watched buyers, owners, and sellers navigate this financial reality. I’ve seen the same mistakes made with heartbreaking regularity, and I’ve also observed the few who consistently defy the odds, turning their vehicles from pure expenses into smarter, more resilient assets. Depreciation isn't a mysterious force of nature; it's a predictable outcome of market forces, consumer behavior, and specific, controllable choices. Let's strip away the confusion and talk about how you can genuinely maximize your vehicle's value, from the moment you consider a purchase to the day you hand over the keys.

The Invisible Anchor: Understanding What Depreciation Really Is

First, let's reframe the conversation. Depreciation is not your car getting worse. In many cases, a three-year-old vehicle is 95% as capable as the day it was new. Rather, depreciation is the market's assessment of desirability. It's the premium buyers pay for novelty, warranty, and certainty, and the discount they demand for assuming risk and wear.

The steepest drop—that infamous first-year or "drive-off-the-lot" hit—is almost entirely about the transfer of title. A new car sold to its first owner is no longer "new" to the market. It’s now a used car, and its price immediately realigns with the used car market, not the manufacturer's suggested retail price. I've watched buyers negotiate fiercely over a $500 accessory, then casually accept a $5,000 depreciation loss in the first 12 months without a second thought. The goal isn't to eliminate depreciation—that's impossible—but to manage its slope.

The Buying Decision: Where the Depreciation Battle is Won or Lost

Your greatest leverage over your car's financial future happens before you sign any paperwork. This is where strategic thinking separates the savvy from the sorry.

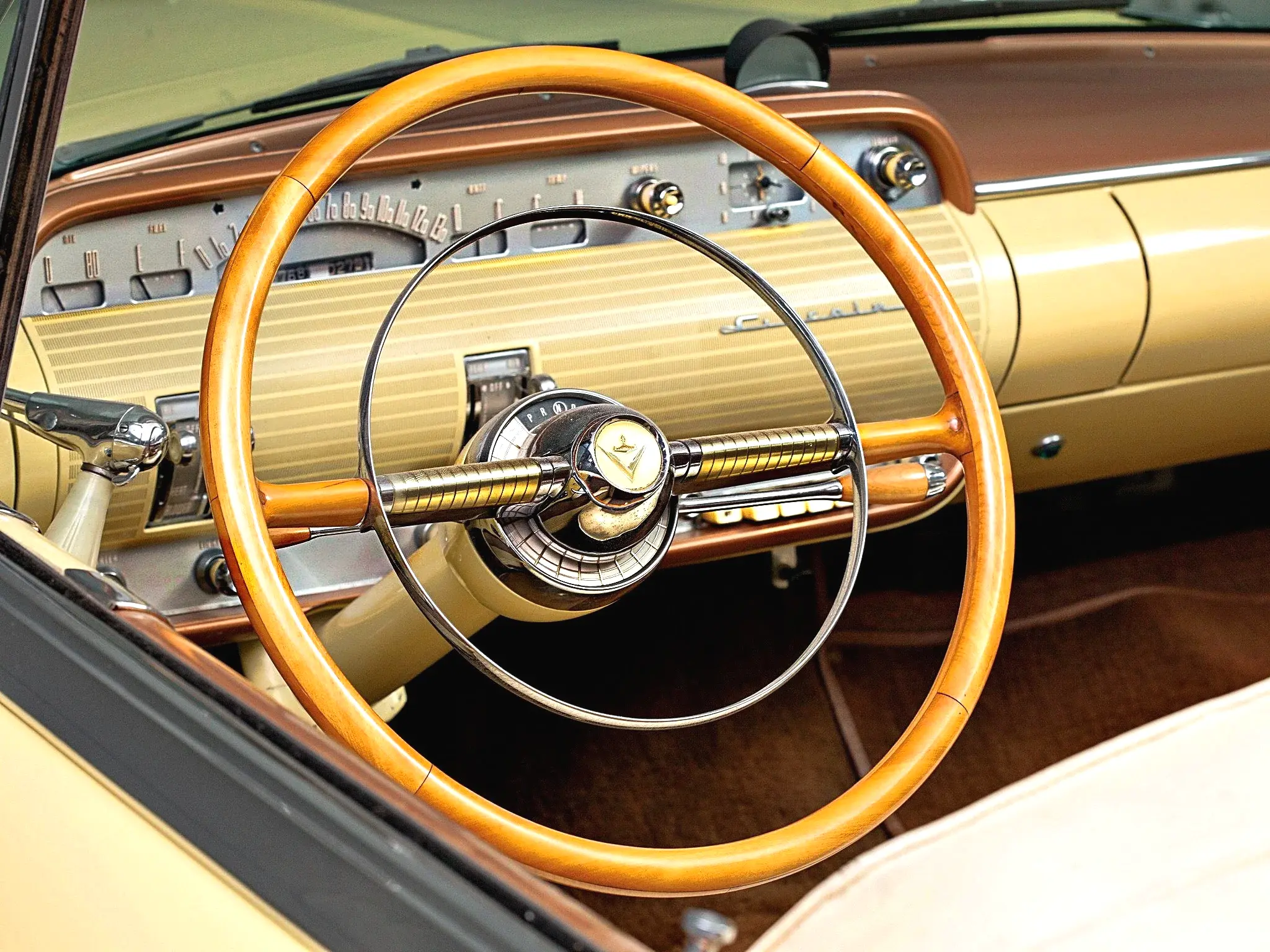

Choose Your Vehicle Category Like an Analyst, Not an Enthusiast (At First). In practice, vehicles depreciate at wildly different rates. Mainstream sedans and family crossovers from high-volume, reliable brands (think Toyota, Honda, Subaru) typically have the shallowest depreciation curves. The market trusts their longevity, and demand for them remains strong. Luxury badges, especially those that rely heavily on fleet sales or aggressive new-car leasing, often plummet fastest. The buyer for a three-year-old luxury sedan is comparing it to a new, heavily discounted one, and the math gets brutal. Niche vehicles—convertibles, performance coupes, large trucks with extreme configurations—can be wild cards; they depreciate heavily unless they become a cult classic.

The "Sweet Spot" in the Used Car Market is a Real Phenomenon. For the depreciation-aware, the single best financial move is to let someone else take that initial hit. Targeting a vehicle that is 2-3 years old is not just generic advice; it's the observable outcome of market mechanics. You're acquiring a vehicle that has already shed 30-40% of its value, but one that likely has most of its factory warranty remaining and is still on its original tires and brakes. I've tracked countless transactions where a 3-year-old CPO (Certified Pre-Owned) vehicle from a reputable brand offers 90% of the experience for 60% of the cost. This is the closest thing to a "free lunch" in the automotive world.

Trim Levels and Options: The Depreciation Trap. Manufacturers love to upsell you on the Premium Plus Tech Package, and while it enhances your enjoyment, it rarely pays you back. High-end infotainment, premium audio, and complex driver-assistance systems are expensive new but commoditized used. A used-car buyer seeks core reliability and condition first. They often won't pay a meaningful premium for features that may be obsolete or costly to repair. If you must have those features, find a used model that already has them—you'll get them for pennies on the original dollar.

The Ownership Years: How Your Behavior Shapes Value

Once the car is in your driveway, your daily decisions write the next chapter of its value story. This isn't about obsessive preservation; it's about avoiding the common, value-destroying pitfalls.

Documentation is Currency. A complete, verifiable service history is the single most powerful tool you have at resale time. I've seen two identical vehicles at auction: one with a folder of dealer receipts, the other with a shrug and "I changed the oil regularly." The difference in final sale price can easily exceed the total cost of all that maintenance. Use the manufacturer's recommended schedule, use quality parts, and keep every record. Digital logs (like CarFax Service History) are excellent, but physical receipts in a folder are undeniable proof.

Cosmetic Condition is a Direct Reflection of Mechanical Care. The market makes an unconscious judgment: a car with stained seats, curbed wheels, and scratched paint is assumed to have been driven hard and maintained poorly. Conversely, a spotless interior and a clean, unblemished exterior suggest conscientious ownership. This isn't about vanity; it's about perceived value. Investing in quality floor mats, sunshades, and the occasional professional detail pays massive dividends. A $200 detail before selling can yield a $1000 higher selling price—I've watched it happen repeatedly.

Mileage: The Inexorable Clock. While you must drive your car, understand the mileage thresholds: 12,000 miles per year is the standard lease benchmark. Staying at or below that pace keeps you in the "average" zone. Crossing 15,000 miles per year starts to negatively impact value, and vehicles over 100,000 miles face a significant mental barrier for many buyers, regardless of condition. If you have a long commute, factor this depreciation cost into your total ownership math. Sometimes, a more depreciated but lower-mileage used car is a smarter buy for a high-mileage driver.

The Selling Strategy: Timing and Technique are Everything

Knowing when and how to exit is the final act of value management. Sell at the wrong time or in the wrong way, and you can undo all your good work.

Identify the Value Cliff (And Sell Before You Go Over It). Cars don't depreciate in a straight line. There are cliffs: when the factory warranty expires (often 3 years/36,000 miles), when major service is due (e.g., timing belt at 60-100k miles), and when a full model redesign hits the market. The sweet spot for private sale value is often around the 4-5 year mark. The car is still modern, often just out of warranty, but the steepest depreciation is behind it. Waiting until it's 8 years old and needs tires, brakes, and a slew of minor repairs means you'll either invest in it or sell it as a "project," both of which crush your net return.

The Private Sale vs. Trade-In Calculus. Trading in is convenient, but it's monetizing your convenience. Dealers must wholesale your car or recondition and retail it for a profit. The offer they give you reflects that. A private sale will always net you more money—often thousands more. The legitimate question is whether that difference is worth your time and effort. For a car in good condition under 7 years old, it almost always is. The internet has made private selling safer and easier than ever. I’ve observed that owners who balk at the "hassle" of a private sale are often leaving 15-20% of their car's value on the table.

Honesty is the Only Policy That Works. Trying to hide a known issue is a fool's errand. An experienced buyer or dealer appraiser will find it, and it destroys all negotiating trust. Be upfront about any flaws. Stating "the front bumper has a repair from a parking lot scrape, and here are the receipts" disarms the buyer and frames the car as honestly represented. This builds confidence, which translates directly into a higher acceptable price.

The Mindset Shift: Your Car as a Managed Asset

Ultimately, maximizing value requires a shift from emotional to tactical thinking. It means:

- Prioritizing Total Cost of Ownership over Monthly Payment. The market is filled with people paying a low monthly note on a car that’s sinking like a stone in value.

- Understanding that "New" is a Feeling, Not a Financial Category. That feeling is expensive. Pay for it consciously if you choose to, not by accident.

- Recognizing that Maintenance is an Investment, Not an Expense. Money spent on proper care is recouped at sale. Money deferred on maintenance is multiplied in value loss.

The least expensive car you'll ever own is the one that retains its value best. It’s not about driving the wheels off a cheap beater; it’s about making intelligent, informed choices that respect the reality of the market. You can't stop depreciation, but you absolutely can steer it. Choose the right vehicle, care for it with documented diligence, and sell it strategically before its major value cliffs. Do that, and you won't just be demystifying depreciation—you'll be mastering it.