The Perpetual Question: Should You Lease or Buy Your Next New Car?

For decades, I've watched the same scene unfold in dealerships and driveways. A buyer, armed with online research and monthly payment calculators, faces the fundamental automotive fork in the road: lease or buy? The decision is often framed as a simple math problem, but in practice, it’s a window into your lifestyle, your financial psychology, and your relationship with the machine in your driveway. The right answer isn’t in a spreadsheet; it’s in the patterns of real-world ownership I’ve witnessed again and again.

Let’s move beyond the abstract “pros and cons” list and examine what this choice actually looks like on the ground, year after year.

The Core Divide: Ownership Mentality vs. Subscription Mindset

This is where the conversation truly begins. Buying is an act of acquisition. You are taking on a long-term asset (that depreciates) and a long-term liability (the loan). Your goal is eventual, debt-free ownership. Leasing, in contrast, is fundamentally a long-term rental. You are paying for the use of the vehicle, specifically for its steepest depreciation period, with no expectation of an equity payoff.

I’ve seen buyers who cherish the idea of “it’s mine” thrive on ownership. They maintain their cars meticulously, drive them for a decade, and find pride in that final payment. I’ve also seen others shackled by a five or six-year loan, staring at a four-year-old car they’re tired of, feeling trapped. Conversely, I’ve watched lessees enjoy a perpetually new car, but also fret over every minor door ding as a potential penalty, living with a constant, low-grade anxiety about the condition of something they’ll never own.

The first question you must answer is: which camp does your personality naturally inhabit?

The Lease: A Deep Dive into the Reality

Leasing is often marketed as the “smart” way to get more car for less money. There’s truth in that, but with significant, observed caveats.

The Observed Advantages (When It Works):

- Lower Monthly Outlay: This is the primary driver, and it’s real. Because you’re only financing the vehicle’s depreciation during the lease term (plus rent charges and fees), your monthly payment is typically 20-35% lower than a loan payment for the same car. For those who prioritize driving a newer, better-equipped vehicle than their cash flow might otherwise allow, this is compelling.

- A Forced Cycle of New Technology: Every 2-4 years, you’re back in a new car with the latest safety tech, infotainment, and efficiency improvements. For tech enthusiasts or safety-conscious families, this predictable upgrade path is a genuine benefit, not a frivolity.

- Hassle-Free Disposal (If You Play by the Rules): At lease-end, you simply hand back the keys. There’s no haggling with private buyers, no dealership trade-in negotiations. You walk away. This simplicity is a massive relief for many.

- The Warranty Umbrella: You are virtually always driving under the factory bumper-to-bumper warranty. Major repair costs are someone else’s problem. This creates a predictable, maintenance-only cost structure that owners of older cars envy.

- Business Tax Benefits: For self-employed individuals or business owners using the vehicle for work, leasing can offer cleaner and sometimes more advantageous tax deductions. This isn’t a minor point; for this group, it’s frequently the deciding factor.

The Real-World Drawbacks (Where People Get Burned):

- The Mileage Trap: This is the classic lease shocker. The 10,000 or 12,000-mile annual limit is a hard ceiling. I’ve seen countless lessees hit their 36-month mark only to face a bill of 20 or 30 cents for every extra mile—a charge that can easily add $2,000 to $4,000 to their final cost. Life changes: a new job, a new relationship, a relocated family member. The lease does not care.

- The Wear-and-Tear Anxiety: “Excessive wear and tear” is a famously gray area. While leases have guidelines, the final assessment is subjective. A leased car must be returned in near-showroom condition. Families with children, pet owners, or people who live in areas with harsh weather or poor roads live with a background hum of potential penalty costs.

- No Equity, Ever: You are building zero ownership stake. Every payment is an expense, like rent. When you walk away, you have nothing to show for it but the memory of a nice car. This is the fundamental economic trade-off.

- You Are Stuck: Terminating a lease early is notoriously, brutally expensive. If your financial situation changes, or you simply hate the car, you have few good options beyond assuming a significant loss.

- Customization is Forbidden: Want to swap the wheels, lower the suspension, or add a non-factory exhaust? Forget it. A lease demands the car be returned in original, unmodified condition. For drivers who see a car as a personal canvas, leasing is a non-starter.

The Purchase: The Long Game of Ownership

Buying, particularly with a loan, is the traditional path. Its benefits are back-loaded; its pains are often front-loaded.

The Observed Advantages (The Payoff):

- Ultimate Flexibility: Own the car free and clear? You can drive it across the country or let it sit in the garage. You can sell it tomorrow for whatever the market will bear. You can modify it, paint it, or let your dog ride in it without a second thought. This freedom is profound and underestimated until you have it.

- Building Equity (Theoretically): Once the loan is paid off, you own a tangible asset. Even if it’s only worth a few thousand dollars, that value is yours to capture as a down payment on your next car, or as cash in your pocket. This creates a cycle of building wealth in transportation, however modest.

- No Mileage or Condition Penalties: This is the mirror image of the lease’s biggest restrictions. The dings, the miles, the wear—they affect only the car’s resale value, which is a future problem you control. For high-mileage commuters or active lifestyles, this is often the deciding factor.

- The Cost Cliff After the Loan: This is the golden period of ownership I see savvy buyers cherish. After 5 or 6 years of payments, you enter a period of 2, 3, or even 5 years with no car payment. Your annual transportation costs plummet to insurance, maintenance, and fuel. This freed-up cash flow is a powerful financial tool.

The Real-World Drawbacks (The Grind):

- Higher Monthly Commitments: To build equity, you must pay more per month. This locks up cash flow and can limit the trim level or model you can afford versus leasing.

- The Burden of Depreciation: As an owner, you bear the full brunt of the car’s value loss. In the first three years, this is staggering. You are making high payments on a rapidly collapsing asset. It feels awful when you think about it too much.

- Out-of-Warranty Risk: Once the factory warranty expires, every dashboard light induces a wave of financial dread. A major repair like a transmission failure can be a catastrophic expense. Responsible owners budget for this, but it’s an unpredictable risk leases eliminate.

- The “Stuck” Feeling of a Different Kind: While you can always sell, being underwater on a loan (owing more than the car is worth) is common in the early years. This can make exiting a car you dislike or that no longer fits your life a financially painful ordeal.

- The Temptation of Long Loans: To get that monthly payment down, buyers are increasingly stretching loans to 72, even 84 months. This is a dangerous trap. You will be paying for a car long after its warranty is gone and its novelty has worn off, often remaining underwater for most of the loan term. I see this as the single worst trend in auto financing today.

The Hidden Factors: What the Brochures Don’t Tell You

Beyond the bullet points, your decision hinges on a few critical, often personal factors.

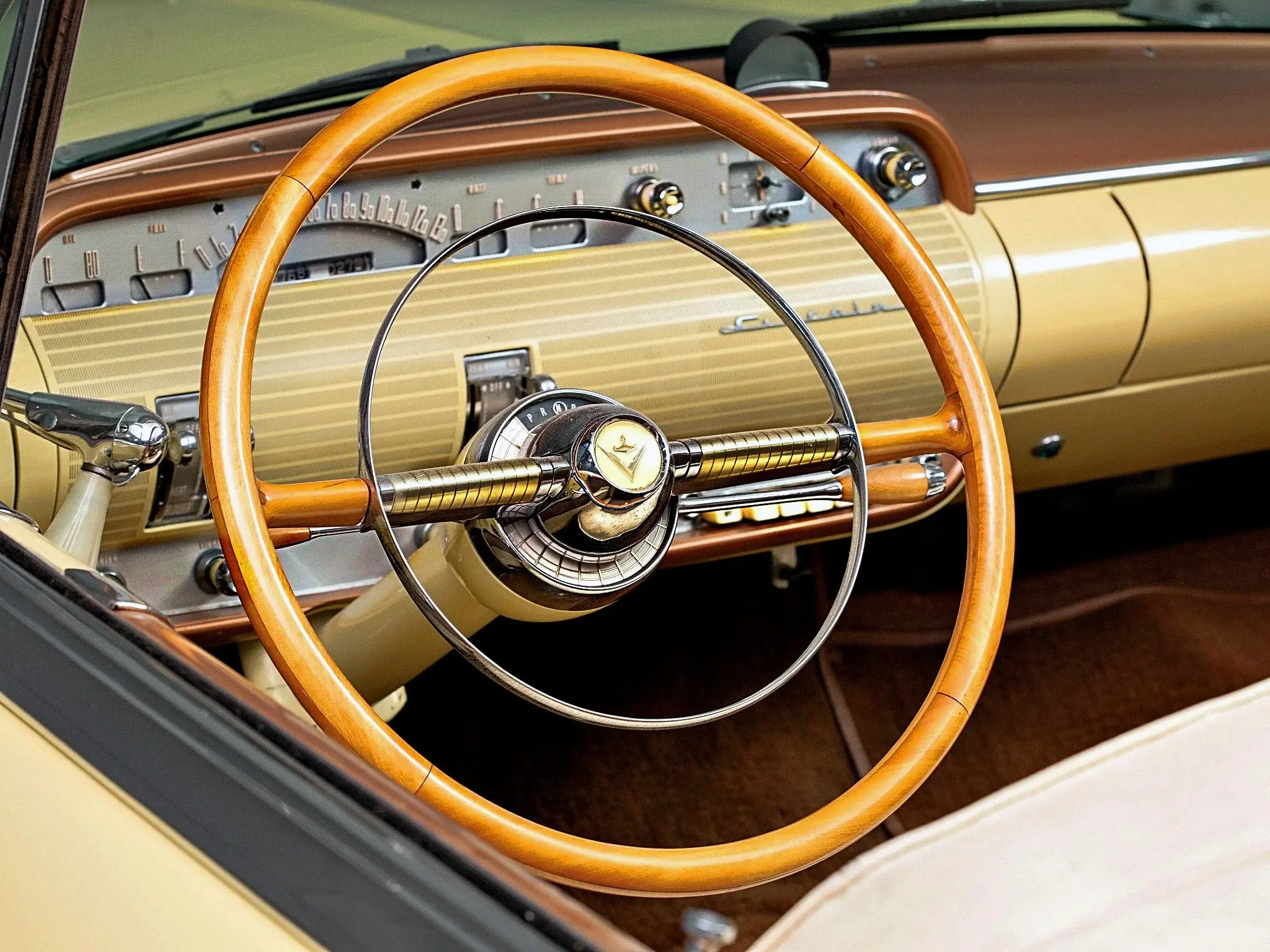

- Your Relationship with Cars: Is a car purely an appliance, a utility to get from A to B? Or is it a source of joy, a hobby, a statement? Appliance users are often better candidates for leasing—they want reliable, modern transportation without hassle. Enthusiasts and tinkerers almost always need to own.

- Your Financial Discipline: Leasing requires discipline on mileage and condition. Buying, especially after the loan is paid off, requires the discipline to save the equivalent of a car payment for maintenance, repairs, and your next down payment. Most people are better at one form of discipline than the other. Be honest with yourself.

- The Opportunity Cost of Cash: If you have the cash to buy outright, the calculation changes. The question becomes: Is the money better used paying for a car in full, or invested elsewhere? A savvy investor might take a low-interest lease and keep their capital in the market. Someone averse to debt might value the peace of mind of a clear title. There’s no universally right answer, only what’s right for your portfolio and psychology.

The Verdict: A Columnist’s Decisive Take

After watching this play out for years, here is my informed, experience-based guidance.

Lease if: Your annual mileage is predictable and below 12,000 miles; you must have a new car every 2-4 years; you cannot tolerate out-of-warranty repair risk; you are a business user who can leverage the tax structure; and you view a car as a service, not an asset. You are paying a premium for convenience and novelty, and that’s a valid choice.

Buy (with a loan) if: You drive more than 15,000 miles a year; you plan to keep a car for 5+ years; you want ultimate freedom from rules and penalties; you have the discipline to manage long-term maintenance costs; and you derive satisfaction from eventual ownership and debt-free driving. You are taking on more short-term cost and risk for long-term financial benefit.

Crucially, if you must take a loan longer than 60 months to afford the payment, you cannot afford that car. Scale back your ambitions. A lower-priced car on a 48-month loan is almost always a wiser financial decision than a stretch loan on your dream car.

In the end, the most expensive car you’ll ever own is the one you’re always paying for. The lease ensures you’re always paying. The purchase, done correctly, offers a path to a period of true, low-cost freedom. Choose based on where you are in life, not just on the monthly payment, and you’ll rarely regret the road you take.